The U.S. Senate on Tuesday passed a resolution (50-47) that would repeal an Obama-era rule that limits racial bias at dealerships amid further evidence that a significant amount of discrimination still takes place at dealerships.

The legislation would overturn the Consumer Financial Protection Bureau’s 2013 bulletin, which caps how much lenders can allow their dealer partners to increase interest rates after the consumer has been approved for a loan. The bill is headed to the House where it is expected to receive a vote today.

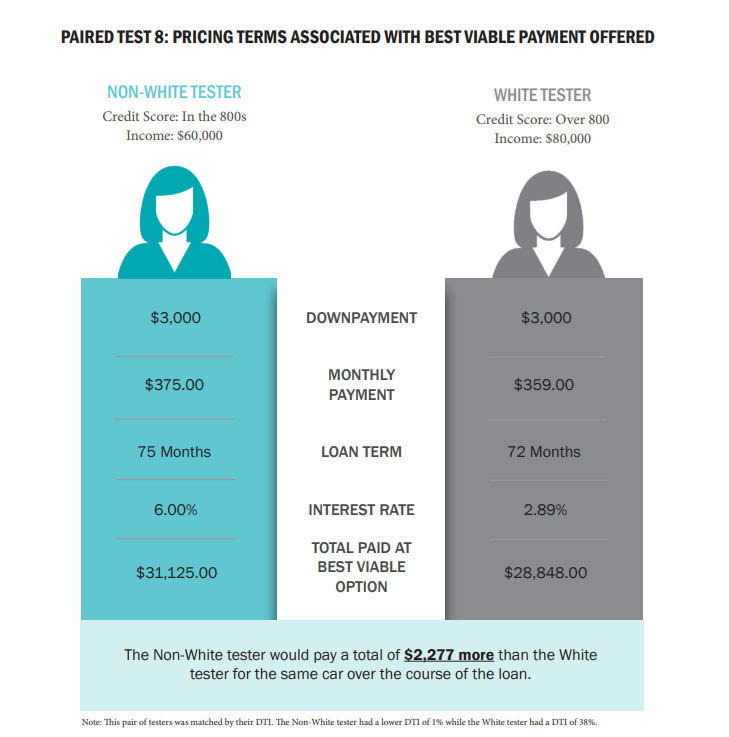

A February study found that 62% of the time more creditworthy non-white borrowers received more costly pricing options over their less-qualified white counterparts, according to the National Fair Housing Alliance. For those non-white consumers, they would have paid an average of $2,662 more than the white borrowers.

The study paired eight white consumers with eight non-white borrowers with higher credit scores each seeking financing at various Virginia dealerships for the same car — all the way down to the VIN number. In a number of cases, the non-white testers were presumed to be less creditworthy when they walked into the dealership and never had their credit scores pulled to prove otherwise, even when it was requested by the borrower.

“If they had taken the step to pull the credit, they would have seen the extent to which the non-white tester was a credible buyer, but they didn’t even in some instances take that step,” Morgan Williams, general counsel for the Fair Housing Alliance, told Auto Finance News. “There was a great lack of transparency that occurred in our tests with our testers across the board, regardless of race. But, when that content was analyzed in the context of race, we found the non-white testers were treated even worst.”

In one of the paired tests, a non-white borrower tried to explain that her credit score was in the 800s and thought the 6% interest rate offered was too high, but the dealership opted to base the rate off of a national average and refused to pull her score to get a lower rate. On the other hand, the white tester seeking financing for the same car got a lower interest rate, shorter term, and a lower monthly payment. The non-white tester would pay a total of $2,277 more than the white tester over the life of the loan.

“There’s no basis for that difference in price other than incentives that lenders are being driven by to increase the cost of these loans,” Williams said. “That [effect] is being experienced most unfavorably by non-white testers.”

While this recent study was limited in scope, Williams said the organization has extensive experience performing similarly constructed tests in the mortgage space and that these results are “probative and can provide some valuable information.” The CFPB and National Consumer Law Center have also found evidence discrimination in the dealer markup process.

“The Bureau has urged all auto financers to move to a method of compensating auto dealers that does not result in disparate impacts on minority borrowers,” Stuart Rossman, staff attorney and director of litigation at the National Consumer Law Center, wrote in a column for The Hill. “Now, some in Congress are calling for the repeal of the auto loan guidance. Congress should be standing with Americans subjected to the injustice of discrimination, not interfering with efforts to enforce fair lending laws.”

On top of advocating for the continuation of the CFPB’s rules, the Fair Housing Alliance goes a step further to say no incentives should exist for this to happen at the dealerships.

“Dealer compensation should not be permitted to vary based on the loan terms, other than the principal balance,” the report states. “Mortgage broker markups were addressed similarly In response to abuses in the subprime mortgage market that led to our most recent housing crash.”

Source : AutoFinanceNews