If you’re on Medicare, the cost of your coverage for doctor’s appointments and other outpatient services is about to rise.

The standard monthly premium for Medicare Part B will be $144.60 for 2020, up $9.10 from $135.50 in 2019, the Centers for Medicare and Medicaid Services announced Friday. The annual deductible for Part B will rise to $198, which is $13 more than the $185 deductible in 2019.

The increases — both around 7% — are due largely to rising spending on physician-administered drugs, according to CMS.

Martin Barraud | OJO+ | Getty Images

“These higher costs have a ripple effect and result in higher Part B premiums and deductible,” CMS said in its announcement.

Some recipients won’t pay the full $144.60 standard premium due to a “hold harmless” provision that prevents their Part B premiums from rising more than their Social Security cost-of-living adjustment, or COLA. For 2020, the Social Security COLA is 1.6%. In 2019, it was 2.8%.

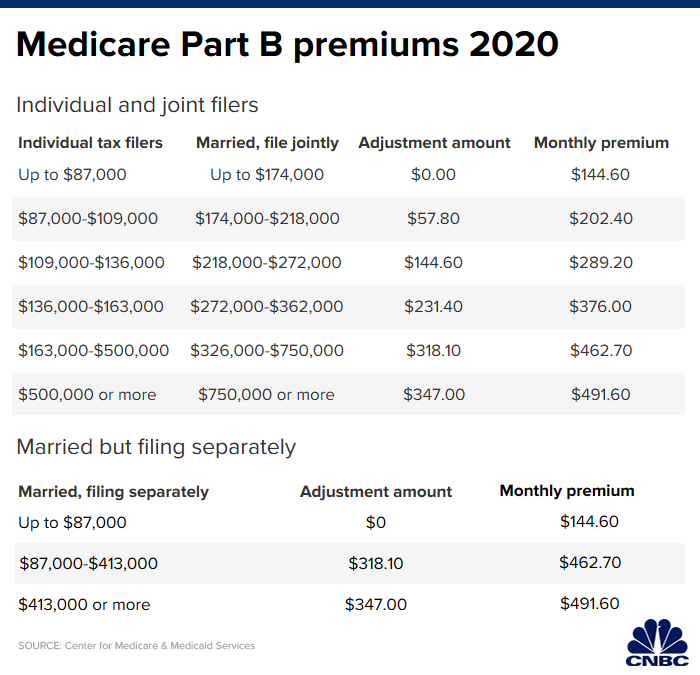

Higher-income beneficiaries, though, have paid more for premiums since 2007 through monthly surcharges. About 7% of Medicare’s 61 million or so beneficiaries will pay more due to those income-adjusted amounts (see table below).

The program uses your tax return from two years earlier to determine whether you’ll pay monthly surcharges. So for 2020, it would be your 2018 return. To request a reduction in that income-related amount due to a life-changing event like retiring, the Social Security Administration has a form you can fill out.

For Part A, which covers inpatient hospital, skilled nursing and some home health-care services, most Medicare beneficiaries do not pay a premium because they have enough of a work history of paying into the system to qualify for it premium-free.

However, there are deductibles that go with Part A. The amount you’ll pay when admitted to the hospital will be $1,408 next year, up $44 from $1,364 in 2019. That covers the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Source : CNBC