Medicare beneficiaries have about two weeks left to evaluate their options for 2020 and make changes for the new year.

While you don’t need to take any action if you want to stick with your current coverage, experts say it’s worthwhile making sure it will still suit your needs next year — and that there isn’t a more cost-effective alternative.

“Each insurance carrier revisits their [drug] formulary and they renegotiate provider contracts,” said Elizabeth Gavino, founder of Lewin & Gavino in New York and an independent broker and general agent for Medicare plans. “So you need to make sure your providers, prescriptions and your preferred pharmacy are still on the plan.”

The ability to pay for health-care needs is one of the most critical issues of retirement.

Hero Images | Getty Images

Additionally, changes can affect your premiums, copays, deductibles and covered services, along with the outlay for your prescriptions. And, you might find coverage that meets your needs at a lower cost.

For Medicare’s 61 million or so beneficiaries, the program’s annual open enrollment period — which started Oct. 15 and runs through Dec. 7 — is the time to make changes that would be effective Jan. 1. During this window, Medicare beneficiaries can:

• Switch to an Advantage Plan from original Medicare (Part A hospital coverage and Part B outpatient care);

• Switch to original Medicare from an Advantage Plan;

• Move from one Advantage Plan to another;

• Move from one prescription drug plan (Part D) to another, or purchase one if you did not when first eligible.

Keep in mind that the current window for making changes is different from a person’s initial enrollment period for Medicare, which starts three months before your 65th birthday month and ends three months after it.

During the enrollment period underway, beneficiaries who plan to compare options using Medicare.gov’s plan finder tool should be aware that it looks different than in past years due to a replacement version — unveiled in August — aimed at being more user-friendly.

While there had been complaints about the tool being riddled with glitches that persisted well into October, it appears many of the kinks have been worked out.

“Once in a while, I will find a medication that’s not on formulary on the Medicare.gov report but I find it on the carrier’s formulary,” Gavino said. “Otherwise, it’s been better.”

More from Personal Finance:

States whose residents are the best at managing their money

This ‘rule’ about credit card use could be costing you

Be on high alert for scams during Medicare open enrollment

Meanwhile, you also might notice some supplemental benefits available through Advantage Plans that you hadn’t seen in the past.

While many plans already offer extras such as dental or vision coverage, new rules allow Advantage Plans to offer services that go beyond traditional medical care. For example, roughly 500 plans are expected to offer services such as adult day care or caregiver support systems next year, according to the Centers for Medicare and Medicaid Services. Another 250 plans will offer things such as meal delivery, rides to the grocery store or even pest control.

However, not all extra benefits are available to everyone who enrolls in the particular plan offering them. Some may only be extended to people with certain chronic illnesses or conditions — and even then, whether you qualify must be assessed by the plan once you’re enrolled.

You won’t know if you’re eligible for those supplemental benefits until you’re in the plan. So don’t be lured in only by the bells and whistles.

David Lipschutz

Associate director for the Center for Medicare Advocacy

“You won’t know if you’re eligible for those supplemental benefits until you’re in the plan,” said David Lipschutz, associate director for the Center for Medicare Advocacy. “So don’t be lured in only by the bells and whistles.”

If you pick an Advantage Plan during fall enrollment and realize afterward that it’s not a good fit, you can change your coverage between Jan. 1 and March 31 by switching to either another Advantage Plan or to original Medicare and a stand-alone prescription plan.

Also be aware that while you can change your mind about your coverage several times during the current open enrollment period, you can only make one change during the January-through-March window.

As for cost: The average monthly premium for Advantage plans will be $23 next year, down from close to $27 in 2019, and 56% of enrollees were in plans with no premium, according to the Kaiser Family Foundation.

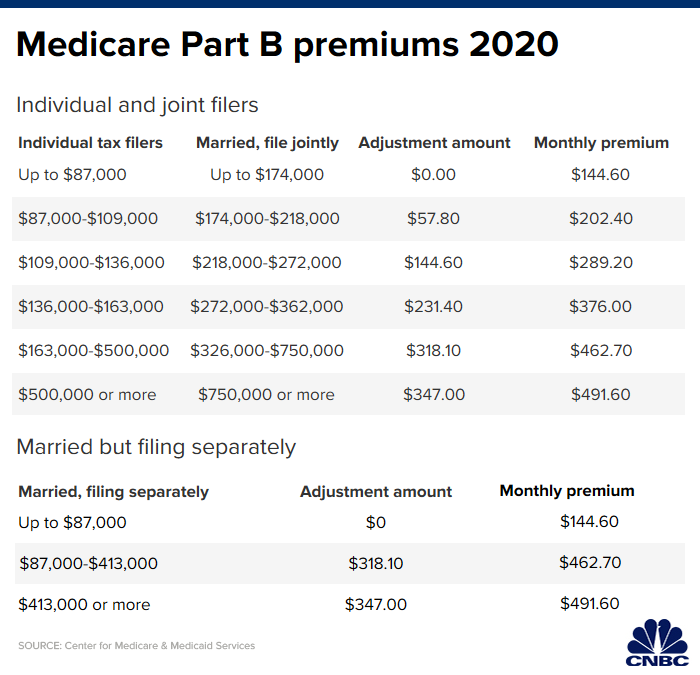

Regardless of the amount, keep in mind that it’s in addition to your Part B premium. That standard monthly cost will be $144.60, up $9.10 from $135.50 this year. About 7% of beneficiaries will pay extra due to income-related adjustment amounts. The Part B deductible also will rise, to $198 from $185 this year.

Deductibles and co-insurance for Part A also are climbing, with the amount you’ll pay when admitted to the hospital at $1,408 next year, up $44 from $1,364 in 2019. That applies to the first 60 days of Medicare-covered inpatient hospital care. For the 61st through 90th days of a hospitalization, beneficiaries will pay $352 per day, up from $341 in 2019.

Additionally, monthly premiums for standalone prescription drug plans will be lower next year, dropping to $30 from $32.50 in 2019, according to government estimates. Remember, though, premiums are only one part of the equation.

Weekly advice on managing your money

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

To make sure your doctor, hospital or other provider still participates in your Advantage Plan, you have to check with the insurance company that offers it. You can either visit the provider’s website or call.

If you work with a Medicare agent, that person should be able to help you figure out what coverage is best for your personal situation. And, Gavino said, make sure the agent includes all plans available to you when evaluating your options — not just the policies they sell.

Also, be aware that if your coverage change involves a Medicare supplemental plan, also known as Medigap, those policies operate under different rules. And while there are some changes in the lineup of Medigap plans available to people turning 65 after this calendar year, they do not affect you if you reach that age before the end of 2019.

Source : CNBC