Orders placed with US factories for business equipment increased in January by the most in five months, suggesting businesses continue to make longer-term capital investments despite high borrowing costs and lingering economic uncertainty.

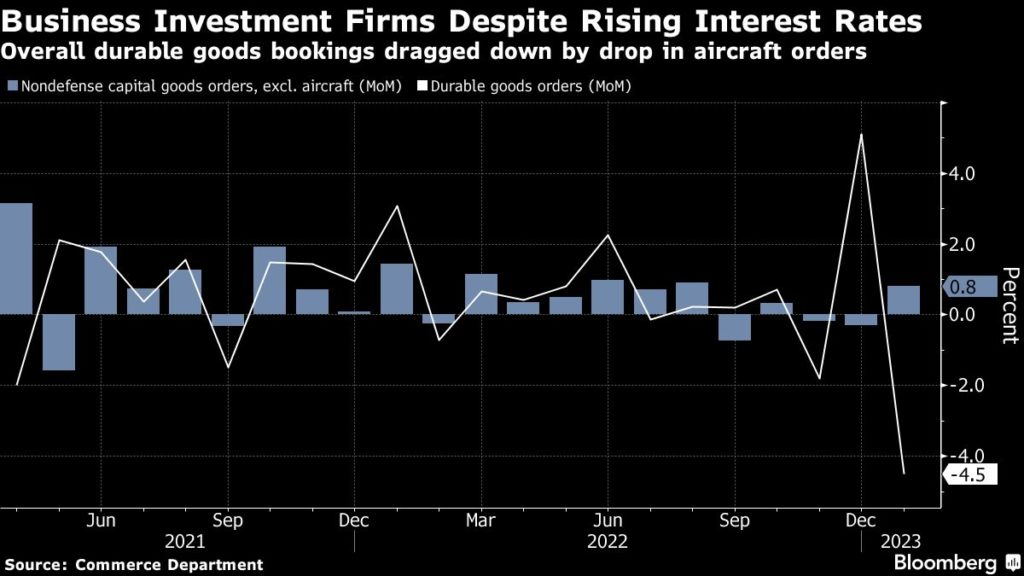

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 0.8% last month after a downwardly revised 0.3% decline in December, Commerce Department figures showed Monday. The data aren’t adjusted for inflation.

The median forecast in a Bloomberg survey called for no change in core capital goods bookings.

Core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, jumped 1.1%.

With a tight labor market keeping upward pressure on wages, many companies are continuing to seek ways to make their workers more productive. Furthermore, if businesses believe a potential downturn will be short and mild, they may be more inclined to continue with capital investment plans.

That said, rising interest rates, inflation and general economic uncertainty may prompt companies to limit expenses.

Machinery and Computers

Orders for machinery, computers and electrical equipment increased in January.

Bookings for all durable goods — items meant to last at least three years — dropped 4.5% in January, the sharpest decline since April 2020 and reflecting a sharp pullback in bookings for commercial aircraft. Excluding transportation equipment, durable goods orders increased 0.7%.

The Commerce Department’s report showed bookings for commercial aircraft, which are volatile from month to month, slumped 54.6%. Boeing Co. reported 55 orders in January compared with 250 in December. While often helpful to compare the two, aircraft orders are volatile and the government data don’t always correlate with the planemaker’s monthly figures.

Survey data have pointed to a weak manufacturing sector. The Institute for Supply Management’s gauge of factory activity has indicated contraction for three straight months, and several regional Federal Reserve banks showed shrinking activity in January.

The report also showed unfilled orders for all durable goods were unchanged while inventories fell 0.1%.

Defense capital goods orders rose 3.8%, boosted in part by military aircraft. Excluding defense, bookings for durable goods fell 5.1%.

(Adds graphic)

–With assistance from Kristy Scheuble.

Source : AutoFinanceNews